lincoln ne restaurant sales tax

Meal 5000 Occupation Tax 2 100remit to City Subtotal 5100 Sales Tax 725 State 55 and City 175. According to the city 2300 restaurants are required to pay the restaurant tax which is a 25 occupation tax on the gross receipts from sales of prepared food and beverages.

The Most Expensive Apartment In New York The 100 Million Dollar Penthouse Http Successandluxury Com Expensive Apartment Expensive Houses Penthouse For Sale

Wayfair Inc affect Nebraska.

. Nebraska and local option sales tax by bars taverns and restaurants. See 19215 Tripadvisor traveler reviews of 725 Lincoln restaurants and search by cuisine price location and more. For tax rates in other cities see Nebraska sales taxes by city and county.

Most recent tax filings. If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email. The calculation of the invoice is shown below.

At httpwwwrevenuenebraskagovinfooccupation_taxhtml Example Restaurant Bill A customer purchases a meal at a restaurant in a city with a 2 occupation tax on restaurants. Nonprofits by category. There will be a 4 percent occupational tax on hotel rooms rental cars and a 2 percent tax on meals and drinks in restaurants and bars.

Did South Dakota v. Pay or View your Lancaster County Property Taxes. 2020 rates included for use while preparing your income tax deduction.

Pay or View Property Tax. The Nebraska state sales and use tax rate is 55 055. 3-2007 Supersedes 6-371-1999 Rev.

To learn more see a full list of taxable and tax-exempt items in Nebraska. To promote the Restaurant industry. The Lincoln sales tax rate is.

Best Dining in Lincoln Nebraska. The printed version has a 7. In Lincoln another 15 percent or one and a half cents is added for a city sales tax.

Groceries are exempt from the Nebraska sales tax. Owners who have not yet paid will not be charged these fees and those who have already paid will receive a credit for the amount paid. The Nebraska sales tax rate is currently.

The current total local sales tax rate in Fremont NE is 7000. Browse through some important dates to remember about tax collections. The current state sales and use tax rate is 55 percent so the total sales and use.

There is no special tax or county tax on this. While Nebraskas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. This page describes the taxability of food and meals in Nebraska including catering and grocery food. Payments will be processed on the first working day after the 25th of the month.

The Nebraska state sales and use tax rate is 55 055. The County sales tax rate is. 025 lower than the maximum sales tax in NE.

NE Sales Tax Rate. 75 Nebraska state sales tax and 125 for counties in Nebraska. It is not intended to answer all questions which may arise but is intended to enable a person to become familiar with the sales tax provisions affecting bars taverns and restaurants.

A total of 7 per cent of Lincoln Nebraskas total sales taxes is required in 2021. You can now make Property Tax payments Real Estate and Personal Property electronically through your bank or a bill payment service of your choice. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022.

No credit card required. Lincolns new occupational tax begins Jan. Promotion of Business.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent t o 175 percent beginning October 1. Rates include state county and city taxes.

Any company may use this online payment system to pay any of the following Occupation Taxes. There is no applicable county tax or special tax. Lincoln has a 5 sales tax rate or 25 for most businesses.

Taxes on the wealthy at 75. Any company may use this online payment system to pay any of the following Occupation Taxes. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. There are no changes to local sales and use tax rates that are effective July 1 2022. There are sales tax rates for each state county and city here.

Nebraska and local option sales tax by bars taverns and restaurants. The 2018 United States Supreme Court decision in South Dakota v. Nebraska Restaurant Association is a promotion of business organization in Lincoln NE whose mission is.

There will be a 4 percent occupational tax on hotel rooms rental cars and a 2 percent tax on meals and drinks in restaurants and bars. You can print a 725 sales tax table here. The latest sales tax rates for cities in Nebraska NE state.

The December 2020 total local sales tax rate was also 7000.

Pinned September 5th 1 Long Islands At Applebees Restaurants Thecouponsapp Shopping Coupons Long Island Iced Tea Applebee S Restaurant

![]()

Panda Express Will Pay 400 000 To The United States And Establish A 200 000 Back Pay Fund To Compensate Workers For Starte Payroll Taxes Labor Law Restaurant

5 Tips For Tipping At Restaurants Real Simple

10 Phoenix Area Restaurants With The Best Desert Views In 2019 Phoenix New Times

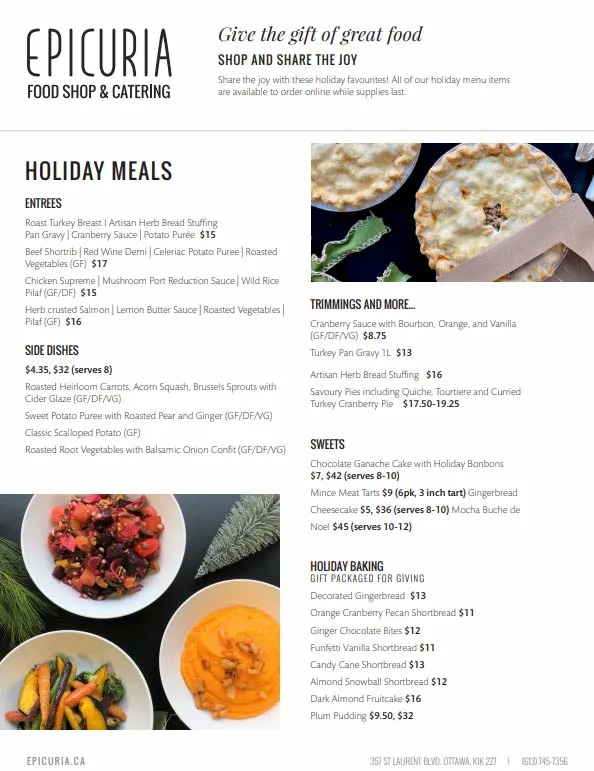

Christmas In Ottawa 2021 Dinner Turkey To Go Brunch Restaurants

Pizza Ranch Guest Satisfaction Survey 2019 In 2021 Pizza Ranch Ranch Pizza Buffet

Piccolo Pete S Restaurant Home Papillion Nebraska Menu Prices Restaurant Reviews Facebook

Equipment Certification Marks Explained Nsf Ul Csa Etl

Panda Express Will Pay 400 000 To The United States And Establish A 200 000 Back Pay Fund To Compensate Workers For Starte Payroll Taxes Labor Law Restaurant

Gift Card Faqs Darden Restaurants

360 The Restaurant At The Cn Tower Toronto On Opentable

How To Start A Pop Up Restaurant Tips Cost Examples 2ndkitchen

Dining Guide The Best Restaurants In Downtown Tempe Phoenix New Times

Everything You Need To Know About Restaurant Taxes

Pin On Lincoln Nebraska Home Sweet Home

Christmas In Ottawa 2021 Dinner Turkey To Go Brunch Restaurants

Welcome To Grade 1 At Renwood Elementary Description From Parmacityschools Org I Searched For This On Bing Com Images Best Location Ohio Parma