does michigan have a inheritance tax

The estate tax is a tax on a persons assets after death. Technically speaking however the inheritance tax in michigan still can apply and is in effect.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Michigan also does not have a gift tax.

. The Michigan Inheritance Tax is still effective BUT ONLY for those beneficiaries that inherited from a person that died on or before September 30 th 1993. Remember the federal gift tax is applied once you give any individual more than 16000 in a single calendar year. Michigan does not have an inheritance tax or estate tax on a decedents assets.

Michigan Inheritance Tax and Gift Tax. That tax is applied to a persons heirs after they have already received their inheritance. The lifetime transfer exemption for.

Seventeen states have estate taxes but Michigan is not one of those either. For individuals who inherited. Does Michigan have inheritance tax.

A copy of all inheritance tax orders on file with the Probate Court. Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and you have inherited the michigan estate in a way that. Michigan does not have an inheritance tax or estate tax on a decedents assets.

The Michigan inheritance tax was eliminated in 1993. Its not a given that i am a. Where do I mail the information related to Michigan Inheritance Tax.

No Michigan does not have an inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. The State of Michigan does.

The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023. There is no federal inheritance tax but there is a federal estate tax. Give any less than.

Only 11 states do have one enacted. Twelve states and Washington DC. Michigan does not have an inheritance tax with one notable exception.

Inheritance tax is levied by state law on an heirs right to receive property from an estate. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The state repealed those taxes in 2019 and so it leaves families or survivors of individuals without those.

Its applied to an estate if the deceased passed on or before Sept. Only a handful of states still impose inheritance taxes. Michigan Department of Treasury.

Thats because michigans estate tax depended on a provision in. Like the majority of states Michigan. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

Death And Taxes Nebraska S Inheritance Tax

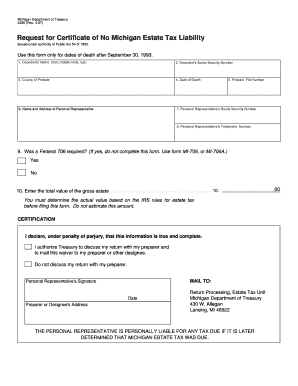

Fillable Online Michigan 2356 Request For Certificate Of No Michigan Estate Tax Liability 2356 Request For Certificate Of No Michigan Estate Tax Liability Michigan Fax Email Print Pdffiller

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Michigan Lady Bird Deed The Major Pros And Cons Explained

Estate Tax Planning Lawyer In Ann Arbor Rutkowski Law Firm Mi

Where Not To Die In 2022 The Greediest Death Tax States

Inheritance Tax Here S Who Pays And In Which States Bankrate

Which States Have Inheritance Tax Mercer Advisors

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Dakroub Group Michigan Does Not Have An Inheritance Tax But There Is A Federal Estate Tax To Look Out For Estateplanning Probate Wills Trusts Deeds Powersofattorney Revocabletrust Assetprotection

Trust Assets Valuation In Michigan Probate Attorney Eastpointe

Fast Guide To Dual State Residency High Net Worth Investors

State Estate And Inheritance Taxes Itep

Federal And Michigan Estate Tax Amounts On Inheritances

Federal And Michigan Estate Tax Amounts On Inheritances